amazon flex tax form download

The FTC is sending payments totaling nearly 60 million to more than 140000 Amazon Flex drivers who had their. And it costs Amazon.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

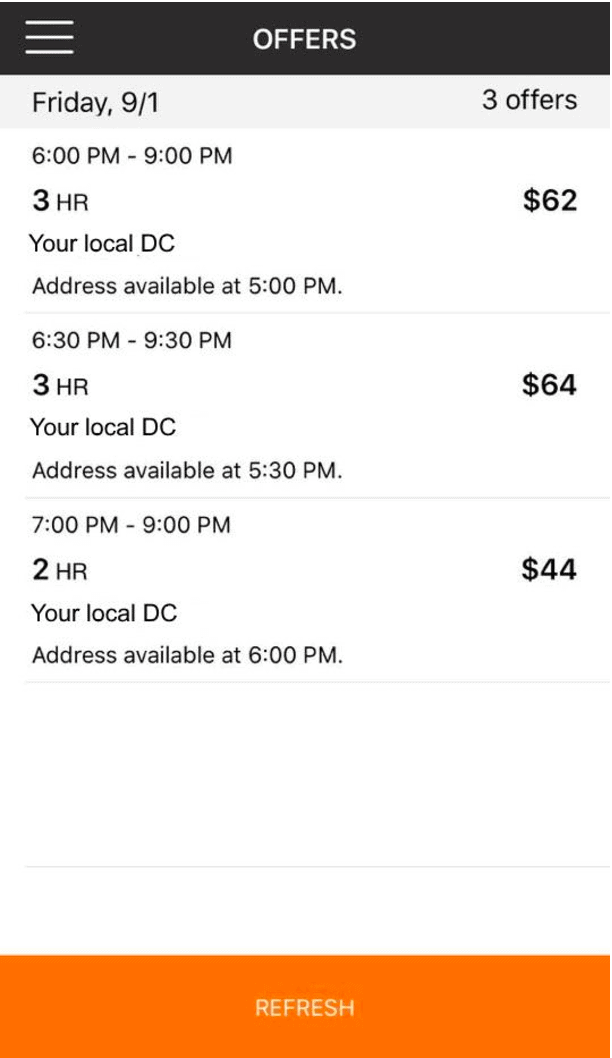

Download and register on the Amazon Flex app become a delivery driver.

. Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least 600 working for the service within the tax year. 1099 MISC Forms 2021 4 Part Tax Forms and 25 Self-Seal Envelopes Kit for 25 Individuals Income Set of Laser Forms - Designed for QuickBooks and Accounting Software 2021 1099. I went to tax central to download a copy and it says no.

We issue Form 1099-MISC on or before January 31 each year or the following business day if January 31 falls on a weekend or legal holiday. Make quicker progress toward your goals by driving and earning with Amazon Flex. Im trying to finish up my taxes.

The standard mileage rate for 2017 is 535 cents per mile and its calculated to include the average cost of gas car payments car insurance maintenance and other vehicle expenses. Ready to become a delivery driver for Amazon Flex in Australia. Click Download to download.

You expect to owe at least 1000 in tax for the current. Want to deliver Amazon parcels in your spare time and earn extra money. NEC stands for nonemployee compensation.

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. You can download the app here for your iPhone or Android and begin your registration. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st.

How to Calculate Your Tax. Click ViewEdit and then click Find Forms. When will I get my tax forms.

FTC RETURNS UNPAID TIPS TO AMAZON FLEX DRIVERS. Sign in using the email and password associated with your account. The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances.

Shop products from small business brands sold in Amazons store. I never got my 1099 from Amazon but I did get my W2s. Discover more about the small businesses partnering with Amazon and Amazons commitment to empowering them.

Lets take a closer look at what this.

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Frequently Asked Questions Us Amazon Flex

Amazon Flex App Everything You Need To Know Full Tutorial Ridester

Amazon Flex Taxes Documents Checklists Essentials

Where To Find Amazon Flex 1099 Form Rideshare Dashboard

Independent Contractor Expenses Spreadsheet Free Template

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Becoming Amazon Flex Driver How To Pros And Cons Salary

How To File Amazon Flex 1099 Taxes The Easy Way

Health Benefits As An Amazon Flex Contracted Employee Mira

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

How To Work For The Amazon Flex Fleet Mileiq

Amazon S Massive Chicago Area Expansion Fueled By 741 Million From Taxpayers Better Government Association

Drivers For Amazon Flex Can Wind Up Earning Less Than They Realize The Seattle Times

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels